The term “Health Insurance” is a lie.

It doesn’t insure your health. So, I’ll use the term “Medical Insurance” here, although that’s not accurate either, as you’ll see below.

“Insurance” is supposed to minimize the financial injury that could result if a low-risk and unexpected event actually occurs.

Medical insurance companies do still serve that traditional role of protecting a patient’s finances from the risk of unlikely calamity (the catastrophic part of insurance). Their actuaries estimate the financials of these risks through examining statistics. This type of insurance provides individuals comfort. That’s good insurance. I want some of that.

But in the USA, what is called “health insurance” is mostly not insurance at all, but a prepaid medical plan.

And this prepaid medical plan screws up everything.

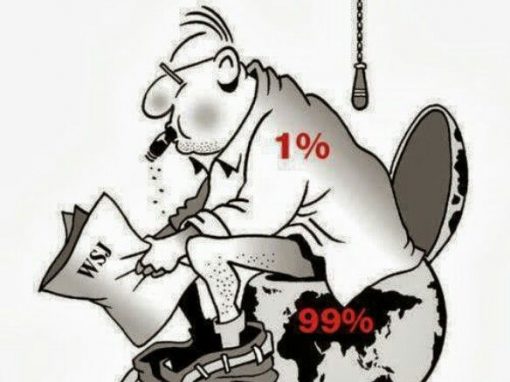

In the multi-century history of insurance (life, fire, etc.), insurance companies’ profits have always been obtained by carefully considering statistics, not individuals. In other words, insurance companies think like collectivists. They’re groupthinkers by their very nature. And any one individual—by design—gets lost in the data.

The politicians have stuck the groupthink mentality of insurance companies into the setting of the very individualized decisions necessary for good medical care. The two cultures—the collectivism of insurance and the individualism of good medical care—clearly conflict. Which wins out?

As the government first subsidized—and then mandated—medical insurance, the culture of good (individualized) medical care has suffered. Most of us have felt that happen. In its place, concepts like evidence-based medicine have moved to the forefront. Invented in Canada, it metastasized to the USA. It’s a type of medical decision-making based on the sort of faceless statistics that insurance company actuaries are so comfortable with. The authors of evidence-based recommendations have never met you, the patient. Their data sets don’t include you, the patient. And yet these distant academics dictate your care.

Very recently, some medical professionals have started clawing back to create a new movement called Personalized Medical Care. One might ask: Isn’t all medical care supposed to be personalized?

Insurance does offer some value: first is the catastrophic financial protection; second is that these companies currently seem to negotiate better than most people can. And someone has to negotiate, because our medical system suffers from aggressive price hyperinflation encouraged by the very same insurance. I don’t mean cost increases. I mean price increases. Two very different things.

Medical insurance directly causes price hyperinflation, because it insulates the patient from the financial impact of their medical care decisions. Imagine sending your teenage daughter off to buy herself boots that you agree to pay for. She’s likely to get the name-brand boots in the most expensive store, and not even ask the price. She won’t shop around for the best price. It’s not her money after all.

It’s the same for medical care. Above the annual deductible, it’s not the patient’s money. It’s the insurance company’s. But it’s worse than the boot analogy, because at least your daughter has loyalty to her parent and might care a bit about saving your money. But the health insurance company is the enemy, hated by the patient for being so expensive and intruding on their doctor’s decisions. Plus the patient isn’t feeling well. So, at best, the patient doesn’t care about the prices (and doesn’t even ask the price). At worst, the patient actively wants to spend the insurance company’s money.

This problem is called a moral hazard and is very well known in the insurance world. I call it the “third-party payer problem.” It affects every decision you make and has ruptured the integrity of everyone involved.

Let’s see how.

The insured patient doesn’t care about the price of medical care. The doctors are entirely oblivious to the price. (Just try to ask the average doctor what a procedure or a clinic visit costs: few, or none, will have a clue.) So the two people engaged in the transaction—the doctor and the patient—either don’t care about the price or are oblivious to it.

You might be forgiven for thinking that at least the insurance companies would want lower prices. But here’s the trick: In our political medical system, the insurance companies actually want higher list prices for medical care!

First, remember that no insurance company pays the list price, ever. Second, the higher the list prices for medical care, the more people feel compelled to obtain the insurance to protect them from the painfully hyperinflated prices. And third, the high prices of medical care prompt politicians—in their infinite ability to screw things up—to do inane things like unconstitutionally force all Americans to buy the same financial products (“health insurance”) that caused the problems in the first place. And insurance companies—like all cronies—love it when politicians mandate the purchase of their crappy products.

So all three parties in the transaction—the doctor (provider), the patient (customer), and the insurance company (third-party payer)—ALL either want the list prices to be higher, or don’t give a damn about the price at all. And so the clinic and hospital administrators take the invitation and raise the list prices for services. And nobody fights it—not the busy doctors, nor the patients.

And this is why we have price hyperinflation. The prices, not the costs, of medical care have soared because of this distorted system of medical expense financing known as the third-party payer system.

(Don’t believe for a second that the high prices are because of high-tech medical care. It’s a lie. High-tech increases productivity and lowers costs everywhere.)

Unfortunately, the “uninsured” patient gets nailed by the hyperinflated list prices, with little power to negotiate them down. And so they either avoid their needed medical care because the prices are too high, or they buy into the insurance scam that caused the hyperinflated prices in the first place.

Insurance is the problem, not the solution.

The Republicans, in fighting against the enactment of Obamacare, used to say that we had the best medical system in the world. That was moronic of them. What we’d developed has become the most expensive system in the world, one filled with intermediaries and administrators who skim money from the system without providing any medical care.

What we had before Obamacare was a crony system of third-party payers that gradually served to take away individual decision-making. By the way, that’s one of the components of fascist economics—government and special interest groups conspiring with each other to take power away from the individual. But at least back then it was voluntary.

What Obamacare did to the medical system was to mandate that we all participate in this economic fascism. Obamacare is the very front line of the fascist advance. But because people stop paying attention when we call their government programs fascist, perhaps it’s best to call them crony.

Politicians have, for decades, misdiagnosed the disease of our sick medical care system. They’ve mistakenly proclaimed that we suffer from too little insurance, when the cause of the problems has always been too much insurance. Then the politicians go on repeatedly to prescribe the wrong therapy. Indeed, through subsidizing via the tax code and mandating “health insurance,” the politicians have forced down our throats the very same toxic poison that made this medical system so sick in the first place. It’s more than just negligent malpractice. It’s assault.

I don’t recommend waiting on the politicians to fix the problems they create. Start thinking now about how you can escape the political medical system before it chokes you to death. It’s valuable to have the comfort of protection from financial catastrophe. But I want the highest deductible “insurance” I can find.

Learning how to negotiate the hyperinflated prices down will come in handy. But it’s hard. There are new tools to help. Healthcare Bluebook will acquaint you with what honest prices should be. And MediBid has doctors all over the country who bid in an auction format to get you the best prices. Check out doctors who practice Direct Primary Care (DPC): for a low monthly fee, DPC docs handle 80% of medical needs and many are available to you 24/7. DPC has made concierge medicine available to the average Joe.

Indeed, there is a small, but growing, set of free market resources out there for patients to use. One would think that free markets in America would be the default. In the medical system, free markets are a remote, but growing, fringe.

Regards,

John Hunt, MD